Conversational AI in Insurance: Enhancing Claims & Customer Support

Discover the leading conversational AI in insurance solutions — from intelligent chatbots to AI voice agents — that streamline claims, enhance customer support and reduce costs.

The insurance industry is massive, with the global market projected to exceed $8.4 trillion by 2026. But as the industry grows, so does the competition. Today’s consumers, whether buying from major carriers or small, independent agencies, expect more than just basic coverage. They demand convenient, consistent, and personalized experiences across every touchpoint.

Let’s explore what conversational AI in insurance looks like today. We will discuss its main uses, business benefits, and real-world examples of successful AI in the insurance industry.

The Evolving Role of Conversational AI in Insurance

As AI becomes more deeply embedded in the insurance ecosystem, companies must adapt or risk falling behind. According to McKinsey’s predictions, the insurance landscape in 2030 will be radically different:

- AI algorithms will allow people to buy auto, commercial, or life insurance in just minutes or even seconds. This will reduce the need for active involvement from both insurers and customers.

- Automated processes will mostly replace traditional underwriting. These processes use machine and deep learning models. They will reduce the time needed to just a few seconds for most personal and small-business products.

- More than 50% of claims will undergo automation. Advanced algorithms will manage initial claim routing. This will improve efficiency and accuracy.

- Conversational AI will predominantly handle customer service across voice and text, enabling faster, smarter, self-learning interactions with minimal human involvement.

While no one can predict exactly how the industry will evolve, insurers can start preparing today. This means learning about new AI technologies. It also means staying ahead of what customers want.

What is Conversational AI in Insurance?

Conversational AI is a kind of artificial intelligence (AI). It allows software applications to have human-like conversations. It leverages technologies like natural language processing, natural language understanding, large language models, and machine learning to understand, interpret, and respond to human language.

In the insurance industry, conversational AI is transforming how providers interact with customers. It enhances customer relationships, streamlines claims processing, and automates underwriting processes.

Depending on your business needs, there are three main types of insurance conversational AI, each offering unique capabilities:

- AI chatbots interact with users through text-based conversations. Early versions relied on predefined scripts and could only handle basic queries like frequently asked questions. Modern AI-powered chatbots are far more sophisticated. They can respond appropriately to a wider range of questions and deliver increasingly personalized, context-aware responses over time.

- AI voice assistants allow users to engage through spoken language. These assistants can answer general inquiries, take messages, and route calls to the appropriate team — streamlining communication and improving the overall customer experience.

- AI voice agents take things a step further. These advanced voice-based systems are capable of handling complex, real-time conversations, both inbound and outbound. By connecting to your company’s knowledge base and other systems, they can understand natural speech and find the right information. This allows them to respond in a way that feels genuinely human.

Conversational AI Use Cases in Insurance

Conversational AI is transforming the customer experience across the insurance lifecycle, from initial onboarding to policy renewal. Here are some of the most impactful insurance AI use cases today:

- Filing claims: AI can guide policyholders step by step through the claims process. It explains what information is needed and helps them submit documents digitally without long waits or confusing forms.

- Managing routine requests: AI chatbots and voice assistants can quickly answer questions about coverage, policy status, or account updates. This reduces call volume for human agents and improves response times.

- Onboarding customers: AI helps gather customer details and explain coverage options. It simplifies the onboarding steps and creates a smooth first experience.

- Payment reminders and confirmations: AI can remind customers about upcoming payments and confirm completed transactions. It can also help set up recurring payments to prevent coverage lapses.

- Claim notifications and status updates: AI keeps customers informed about their claim status from start to finish. It delivers updates through their preferred channel such as SMS, email, or chat.

- Policy renewals: AI notifies customers when it’s time to renew. It can also guide them through the renewal process to make it faster and easier.

- Personalized offerings: AI uses customer data and past interactions to recommend relevant add-ons or upgrades. This helps unlock additional revenue opportunities.

Benefits of Conversational AI in Insurance

Here are the key benefits driving adoption across the industry:

A Modern Customer Experience

Conversational AI offers fast, reliable, and user-friendly interactions that align with today’s customer expectations. It answers questions, helps with claims, and explains policy options. This creates a smooth and responsive experience at every step.

Always-On, Effortless Customer Support

Insurance customers do not want to wait, especially in urgent situations. Conversational AI is available 24/7. Users can file claims, check policy details, or get quick support anytime without dealing with complex systems or long waits.

Reduced Operational Costs

Conversational AI handles routine tasks like answering common questions, booking appointments, and collecting documents. This reduces operational costs and frees up human agents to focus on complex, high-value issues.

Personalized Service & Smarter Sales

By using real-time insights and past interactions, conversational AI can suggest tailored recommendations, relevant policy add-ons, or available discounts. This helps providers build stronger customer relationships and increase upsell opportunities.

Faster & Simpler Claims Management

Conversational AI streamlines the claim processing from start to finish. It helps users submit claims quickly, keeps them updated throughout the process, and eliminates manual bottlenecks. This leads to faster resolutions and improved customer satisfaction.

A Competitive Edge

Offering intelligent conversational support sets insurers apart. With faster service, personalized customer interactions, and a seamless digital experience, conversational AI gives companies a clear edge in building customer loyalty and staying ahead of competitors.

Easy Scalability

As your business grows, conversational AI grows with you. It can manage thousands of conversations at once, support multiple languages, and adapt quickly to changes, making it an ideal solution for expanding your operations without sacrificing high quality.

Challenges in Adopting Conversational AI in Insurance

Conversational AI can deliver major benefits for insurers but getting it right comes with challenges. Addressing these early on is essential for long-term success.

Data Privacy and Compliance

Insurers collect and process highly sensitive personal and financial information, so their conversational AI systems must comply with data protection regulations like GDPR and HIPAA, as well as local laws. Prioritizing encryption, secure storage, and transparent consent processes is vital to building customer trust and avoiding legal risks.

Security Risks

AI-powered systems are enticing targets for cyber threats, including spoofing, phishing, and data breaches. To ensure safe interactions, insurers must implement strong encryption, authentication protocols, and real-time threat monitoring.

Avoiding Over-Automation

Automation can lower costs and improve efficiency. But relying on it too much can hurt the customer experience, especially in complex or sensitive situations. It’s important to keep the right balance between AI efficiency and human empathy.

Language and Tone Sensitivity

Insurance conversations often involve high-stakes situations like accidents, medical emergencies, or financial loss. If the AI responds in an overly robotic or inappropriate tone, it can damage customer trust. Designing empathetic, context-aware dialogue flows is a significant challenge.

High Upfront Costs

Conversational AI can save money over time. But the upfront costs for technology, integration, and staff training can be high. This can be challenging for smaller insurers with limited budgets.

That said, affordable and flexible solutions do exist. Providers like DialLink offer conversational AI tailored to the needs and budgets of SMBs. This helps them deliver modern customer service without breaking the bank.

From Theory to Reality: Examples of Successful Implementation of Conversational AI in Insurance

Conversational AI has already demonstrated its transformative potential in the insurance industry. Here are some real-world examples of companies that have implemented insurance chatbots and voice assistances to drive measurable results:

Allstate: Empowering Agents with AI

Allstate developed ABIe (Allstate Business Insurance Expert), a conversational AI assistant designed specifically to support internal agents with business insurance policies. Every day, thousands of Allstate agents turn to ABIe for fast answers that once required a call center. It is now the preferred support tool, helping agents quote, sell, and issue business insurance more efficiently.

ABIe also lets teams quickly share FAQs and updates. It is becoming a key channel for delivering support and communication to agents.

Key success metrics include the following:

- ABIe now handles over 25,000 agent inquiries each month, significantly reducing the volume of calls routed to the underwriting support center.

- The chatbot supports quote completion, product information, and procedural guidance, all without live agent intervention.

- Adoption continues to grow. With usage increasing by 10% month-over-month, showing strong agent confidence and trust in the AI insurance software.

Lemonade: Transforming Insurance with AI-Powered Assistants

Lemonade, a U.S.-based insurtech company, has disrupted the insurance industry with its AI-first approach. At the center of their approach is AI Jim, a conversational claims bot that guides users through the claims process. It also uses backend AI models to review claim data and approve payouts.

AI Jim handled over 28k requests a year without human intervention. In one notable case, it processed and paid out a claim in just 2 seconds, setting a world record.

Lemonade also uses AI Maya, a chatbot that manages customer onboarding, quotes, and policy setup, creating a fast and user-friendly experience.

Together, these AI tools help Lemonade keep expenses low, reduce support costs, and scale efficiently. The company now serves more than 1.9 million customers across the U.S. and Europe.

Unlock the Power of Conversational AI for Your Insurance Company

Chatbots in insurance are no longer a trend — they are a mainstay. The benefits they deliver to both insurers and policyholders are significant, transforming slow, manual processes into quick, seamless interactions. Conversational AI is changing how insurers support customers at every stage. It can answer policy questions, speed up claims, send payment reminders, and help with renewals.

And the best part? You do not need a massive IT team and budget to get started.

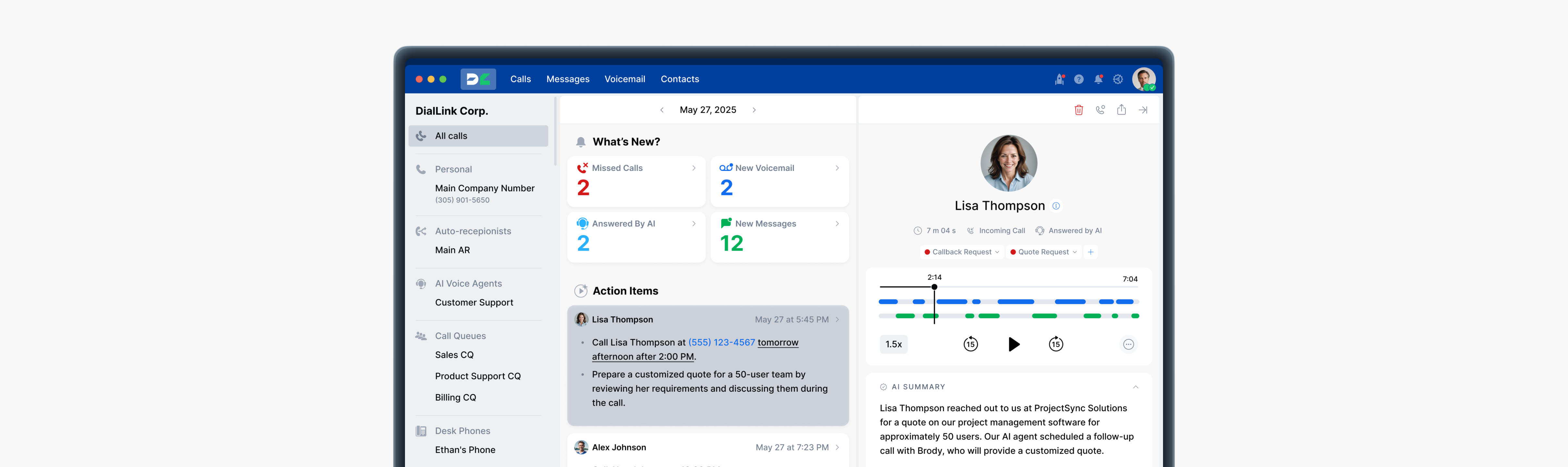

DialLink’s cloud-based phone system is designed with simplicity in mind, making it refreshingly easy for insurance businesses to get started with conversational AI. It’s simple to set up, intuitive to use from day one, and doesn’t require developers or consultants. Even for advanced features like AI voice agents. Without writing a single line of code, you can quickly deploy agents to handle 24/7 support, qualify leads, schedule appointments, and more.

Featured Tags

Share

In this article

- The Evolving Role of Conversational AI in Insurance

- What is Conversational AI in Insurance?

- Conversational AI Use Cases in Insurance

- Benefits of Conversational AI in Insurance

- Challenges in Adopting Conversational AI in Insurance

- From Theory to Reality: Examples of Successful Implementation of Conversational AI in Insurance

Arina Khoziainova

Content Writer at DialLink

Arina is a content writer with over 7 years of experience in the IT industry. At DialLink, she creates clear, insightful content that helps small business and startup owners simplify communication and drive growth using modern tools. With a strong focus on practical value, Arina transforms complex topics into accessible, actionable stories.

Keep Reading

Adapt or Fall Behind: The Truth About Conversational AI for Small and Medium Businesses

Cut through the AI hype and explore the real-world benefits small businesses can achieve today with conversational AI.

Conversational AI in Banking and Financial Services

Discover how conversational AI like chatbots and AI assistants improved efficiency and service in financial services.

Conversational AI in Call Center: Transforming Customer Service

Discover how conversational AI transforms call centers with smarter support and better customer experiences while reducing operational expenses.

How Small and Medium Businesses Can Use Conversational AI

Discover how conversational AI helps small and medium businesses provide exceptional customer service without the need for additional staff.

5 Conversational AI Examples: Improve Customer Experience Across Industries

Explore real-world conversational AI use cases that apply to every industry to automate customer support, streamline business operations, and personalize user experiences.

Artificial Intelligence Calls: Definition, Examples, and How It Works

Learn what artificial intelligence calls are, how they work, and how your business can benefit from using AI-powered voice calling solutions.

How DialLink Leverages MCP to Streamline AI Integrations

Discover how DialLink leverages MCP to connect AI Voice Agents with AI models and business tools, enabling them to solve real business challenges.

Text-to-Speech and Speech-to-Speech: How Each Can Benefit Your Business?

Explore both technologies that power AI voice agents, their pros and cons, and how to choose the best fit for your business needs.