Conversational AI in Banking and Financial Services

Discover how conversational AI like chatbots and AI assistants improved efficiency and service in financial services.

Financial organizations are under mounting pressure to deliver 24/7 personalized experiences across multiple platforms while keeping costs in check and staying compliant with regulations. Zendesk reports that 72% of customers expect immediate service. 70% want every interaction to reflect their full history.. And 62% believe experiences should move seamlessly between digital and physical touchpoints.

To meet these rising demands, banks are increasingly adopting AI-powered technologies. Gartner predicts that by 2026, 90% of finance functions will implement at least one AI-enabled solution. At the same time, consumer trust in AI is growing. According to Zendesk, 59% of respondents say they’re comfortable receiving financial assistance from AI agents.

Now is the time for financial institutions to use AI to deliver smarter, faster, and more intuitive support. This article explains how conversational AI is changing banking, with clear examples, use cases, and the impact it has across the industry.

What is Conversational AI in Banking?

Conversational AI for banks uses artificial intelligence technologies to facilitate automated, human-like interactions between financial institutions and their customers. These interactions typically occur through AI chatbots, virtual assistants, and AI voice agents.

At the core of conversational AI are natural language processing (NLP) and large language models (LLMs).

- Natural language processing (NLP) helps the system understand what users mean when they speak or type.

- Large language models (LLMs) take this step further by adding deeper contextual understanding. They help the system provide more natural, relevant responses and support more complex conversations.

Additionally, AI systems leverage APIs and integrate with back-end databases. For banks, this creates a unified ecosystem that connects account management, transaction histories, call management processes, and customer relationship management (CRM) platforms.

Key Components of Conversational AI for Banking

Building a successful conversational AI experience in banking and finance takes more than just deploying a chatbot or a voice assistant. It requires a strategic blend of technology, data, and design. Here are the core components that make it work:

- Industry-specific training models — Financial conversations involve unique terminology and complex scenarios, like checking loan eligibility, understanding credit scores, or resolving disputes. To handle these interactions well, conversational AI needs finance-specific training. It should use models built for the industry’s rules, workflows, and customer expectations.

- Context management — Financial conversations often span multiple steps or sessions. A strong conversational AI should retain context, such as remembering that a user asked for their account balance before requesting a cash transfer. This makes the interaction feel seamless.

- Sentiment analysis — Tone matters, especially in finance, where emotions often run high. Sentiment analysis enables the AI tool to detect emotional cues such as frustration, urgency, or confusion.

- Omnichannel integration — Conversational AI should deliver a connected experience across all channels: web, mobile apps, voice assistants, messaging apps, and even in-branch kiosks.

- Security & compliance — In finance, trust is everything. AI systems must follow strict data privacy regulations (like GDPR or PCI DSS), authenticate users securely, and log interactions for auditing. Features like biometric authentication and encryption help ensure that the system is safe as well as smart.

- Personalization — AI systems should tailor responses to each person. They can recommend products or flag unusual activity based on a customer’s profile, preferences, and history.

- Analytics & continuous learning — Conversational AI platforms should come with dashboards and reporting tools for tracking metrics like resolution rate, sentiment, and drop-off points. Machine learning models can use this data to improve system performance over time.

- Human handoff capability — Not every query can be resolved by AI. A smooth handoff to human agents is essential to avoid frustration and ensure continuity in service.

Conversational AI Use Cases in Banking

Conversational AI is reshaping how banks interact with customers, bringing speed, personalization, and automation to the forefront. Below are real-world use cases that demonstrate its value across the customer journey.

Account Management

Conversational AI helps customers check balances and view transactions. It also lets them manage cards and handle simple tasks like changing passwords or updating contact details.

Customer Support

AI-powered virtual assistants handle a high volume of common queries 24/7. AI-powered virtual assistants handle a high volume of common queries 24/7. Conversational AI can answer FAQs and help resolve technical issues. It reduces wait times, improves the customer experience, and lowers operational costs.

Outbound Communication

Banks can use AI to automate outbound calls and messages. Whether promoting new financial products, conducting satisfaction surveys, or following up on recent transactions. This allows for proactive engagement at a scale without overburdening human agents.

Payment Reminders & Collections

AI can gently remind customers of upcoming payments, offer flexible payment options, and even guide clients through resolution steps for overdue accounts. This helps improve repayment rates while maintaining a positive tone.

Loan & Mortgage Processing

Applying for a loan or mortgage is often a lengthy process. Conversational AI simplifies it by gathering applicant information, answering eligibility questions, and providing status updates, reducing friction and speeding up the loan application process.

Personalized Financial Advice

AI assistants can review a person’s spending, income, and goals to give personalized advice. They can offer savings tips, suggest budget changes, or recommend investment products that fit their needs.

Fraud Detection & Prevention

Conversational AI can flag suspicious activity in real time and initiate a secure verification process. If a customer receives a fraud alert, the AI can walk them through how to verify the transaction or freeze their card.

Customer Onboarding & KYC

Conversational AI makes onboarding easier by guiding customers through KYC steps and identity verification. It ensures compliance while keeping the process smooth and easy to follow.

Routine Inquiries

For everyday questions like locating the nearest ATM or branch, AI banking chatbots provide quick and accurate responses. This option enhances convenience for customers and frees up human agents to focus on more complex tasks.

Benefits of Conversational AI in Banking

Here’s a look at the key benefits:

- 24/7 service availability — Conversational AI supports customers day or night. It can help with account questions, simple transactions, and general assistance at any time. As a result, banks can ensure uninterrupted service and increase customer satisfaction.

- Improved customer support team efficiency — AI automates many repetitive tasks, such as onboarding, balance checks, fraud alerts, and loan application steps. This reduces manual work and speeds up service across departments.

- Cost savings - By automating high-volume, low-complexity interactions, banks reduce calls to human agents and lower support center costs. This leads to better ROI on digital channels.

- Omnichannel support - Conversational AI works across apps, websites, messaging platforms, and voice assistants. It provides a consistent, seamless experience no matter where the customer interacts.

- Improved customer experience — Faster responses, simpler processes, personalized help, and always-on availability create a smoother and more intuitive banking experience. This helps build trust and loyalty.

- Enhanced security — AI can work with multi-factor authentication tools, such as voice recognition, and integrate with real-time fraud monitoring. This keeps financial interactions both safe and convenient.

- Personalization — AI connects to CRMs, core banking systems, and analytics platforms. It uses customer data to offer more personalized support and better recommendations.

- Competitive advantage — Banks that use conversational AI deliver faster and smarter service. This helps them attract tech-savvy customers and stand out in the market.

- Business scalability — Conversational AI can manage thousands of interactions at once. It scales across languages and regions and adapts quickly to changes in demand or new services.

Challenges in Adopting Conversational AI in Banking

Conversational AI offers major benefits, but implementing it in banking also brings technical, regulatory, and cultural challenges. Here are some of the most common ones.

- Compliance: Banks must follow strict data protection rules like GDPR, CCPA, and other finance-specific laws. These regulations control how personal financial data is used and stored. Ensuring that AI systems handle sensitive information securely and transparently is non-negotiable.

- Security risks: AI-powered interactions are vulnerable to cyber threats such as spoofing, phishing, and data leaks. Implementing robust encryption, MFA, and real-time monitoring is essential to maintain trust and prevent fraud.

- Integration with legacy systems: Many banks operate on outdated infrastructure that doesn’t easily support modern AI tools. Integrating conversational AI with core banking systems, CRMs, and analytics platforms can require extensive customization and investment.

- Balancing automation with the human touch: AI can handle many interactions. Banks must also ensure that complex, emotional, or high-stakes conversations are passed smoothly to a human agent. Balancing automation with empathy is key to maintaining service quality.

- Understanding context: Financial language is nuanced and varies across regions, customer types, and use cases. Training conversational AI to accurately interpret intent, context, and industry-specific terms takes time and domain expertise.

- Customer hesitation: Some customers are still reluctant to engage with AI, especially in financial matters. Building trust through clear communication, human fallback options, and consistent performance is critical to increasing adoption.

Examples of Conversational AI Implementation in Banking

Conversational AI is becoming more common across all types of financial institutions, including banks, credit unions, and fintech startups. These organizations are leveraging AI to enhance customer experience, streamline operations, and provide personalized services. Here are several examples of how financial institutions are already using conversational AI.

Bank of America: Erica

Bank of America’s virtual assistant, Erica, is one of the best-known AI tools in banking. It helps customers manage their accounts by tracking spending, making payments, and giving personalized financial tips based on their habits.

Since its launch in 2018, Erica has handled more than 2 billion customer interactions. It has answered 800 million questions from over 42 million customers and provided personalized insights over 1.2 billion times.

PenFed Credit Union: Penelope

Penelope is a conversational AI chatbot for PenFed Credit Union members. It helps with tasks like checking account balances, prequalifying for loans, and tracking credit card payments. Currently, Penelope handles nearly 40,000 sessions each month and assists with loan status updates, product information, service questions, and technical support. It also resolves about 20% of cases on the first try.

By giving quick, automated answers to routine questions, Penelope improves the member experience and frees staff to focus on more complex issues. It has also helped reduce response times in PenFed’s call center, even as membership grew by 31%.

NuBank: AI-Powered Virtual Assistants

NuBank, a Brazil-based neobank, uses AI virtual assistants on its mobile and online platforms. It help customers check balances, complete transactions, and get personalized financial advice.

Built with OpenAI, these assistants handle over 2 million monthly chats and emails. They resolve issues 2.3 times faster than human agents. It also handles half of all basic support requests without needing escalation.

Because of this, NuBank has reduced response times by 70% and allowed human staff to focus on more complex needs. All while keeping service quality and Transactional Net Promoter Scores (tNPS) high.

Lemonade: AI-Powered Chatbot for Insurance and Banking

Fintech startup Lemonade uses an AI chatbot called Maya to help customers get quotes, buy policies, and manage claims. Maya handles over 25% of all customer inquiries, significantly reducing operational costs while enhancing customer satisfaction with fast and accurate service. In fact, Maya settled an insurance claim in just two seconds — a groundbreaking achievement.

Explore the Potential of Conversational AI for Your Financial Business

Conversational AI is no longer a nice-to-have for modern banks and financial institutions. It has become essential for delivering great customer experiences, improving efficiency, and staying competitive.

Importantly, this technology is not reserved for large banks with massive IT budgets. Small and medium-sized financial institutions can also harness the power of conversational AI through scalable, cloud-based solutions. They can reduce costs, extend support availability, and provide modern, personalized experiences that rival those of their larger competitors.

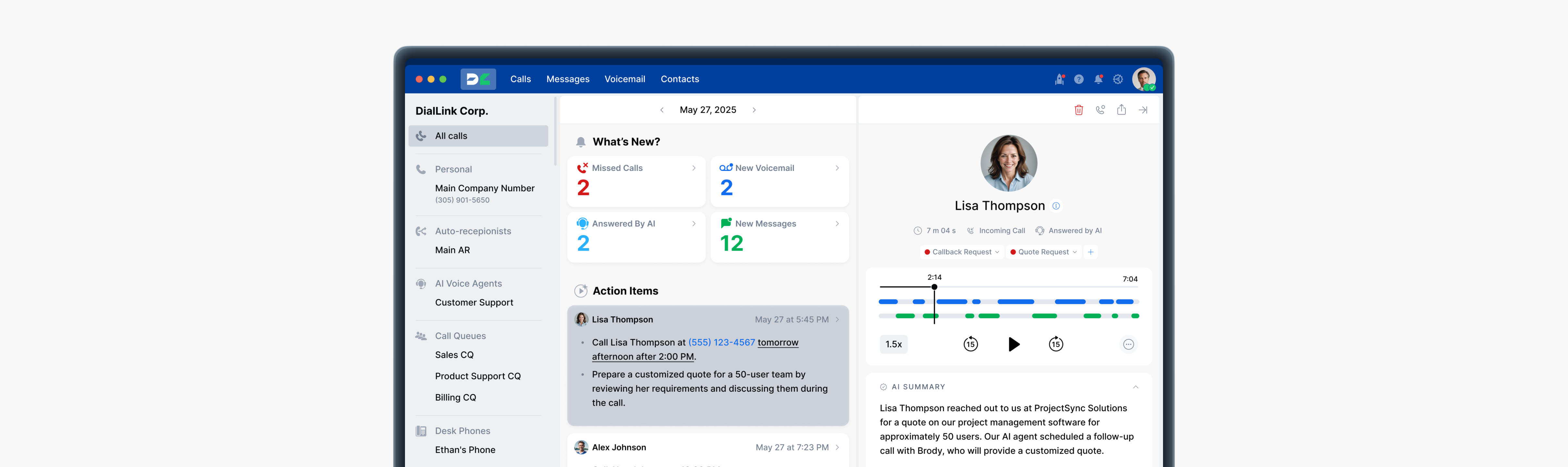

The DialLink business phone system is a perfect example. It helps growing businesses deliver smarter, faster, and more professional customer interactions. DialLink is easy to set up and includes powerful AI features. Its built-in AI voice agents require no developers or complex setup.

Ready to bring the power of conversational AI to your business? Let’s take the next step together.

Featured Tags

Share

In this article

- What is Conversational AI in Banking?

- Key Components of Conversational AI for Banking

- Conversational AI Use Cases in Banking

- Benefits of Conversational AI in Banking

- Challenges in Adopting Conversational AI in Banking

- Examples of Conversational AI Implementation in Banking

- Explore the Potential of Conversational AI for Your Financial Business

Arina Khoziainova

Content Writer at DialLink

Arina is a content writer with over 7 years of experience in the IT industry. At DialLink, she creates clear, insightful content that helps small business and startup owners simplify communication and drive growth using modern tools. With a strong focus on practical value, Arina transforms complex topics into accessible, actionable stories.

Keep Reading

Adapt or Fall Behind: The Truth About Conversational AI for Small and Medium Businesses

Cut through the AI hype and explore the real-world benefits small businesses can achieve today with conversational AI.

Conversational AI in Insurance: Enhancing Claims & Customer Support

Discover the leading conversational AI in insurance solutions — from intelligent chatbots to AI voice agents — that streamline claims, enhance customer support and reduce costs.

Conversational AI in Call Center: Transforming Customer Service

Discover how conversational AI transforms call centers with smarter support and better customer experiences while reducing operational expenses.

How Small and Medium Businesses Can Use Conversational AI

Discover how conversational AI helps small and medium businesses provide exceptional customer service without the need for additional staff.

5 Conversational AI Examples: Improve Customer Experience Across Industries

Explore real-world conversational AI use cases that apply to every industry to automate customer support, streamline business operations, and personalize user experiences.

Artificial Intelligence Calls: Definition, Examples, and How It Works

Learn what artificial intelligence calls are, how they work, and how your business can benefit from using AI-powered voice calling solutions.

How DialLink Leverages MCP to Streamline AI Integrations

Discover how DialLink leverages MCP to connect AI Voice Agents with AI models and business tools, enabling them to solve real business challenges.

Text-to-Speech and Speech-to-Speech: How Each Can Benefit Your Business?

Explore both technologies that power AI voice agents, their pros and cons, and how to choose the best fit for your business needs.